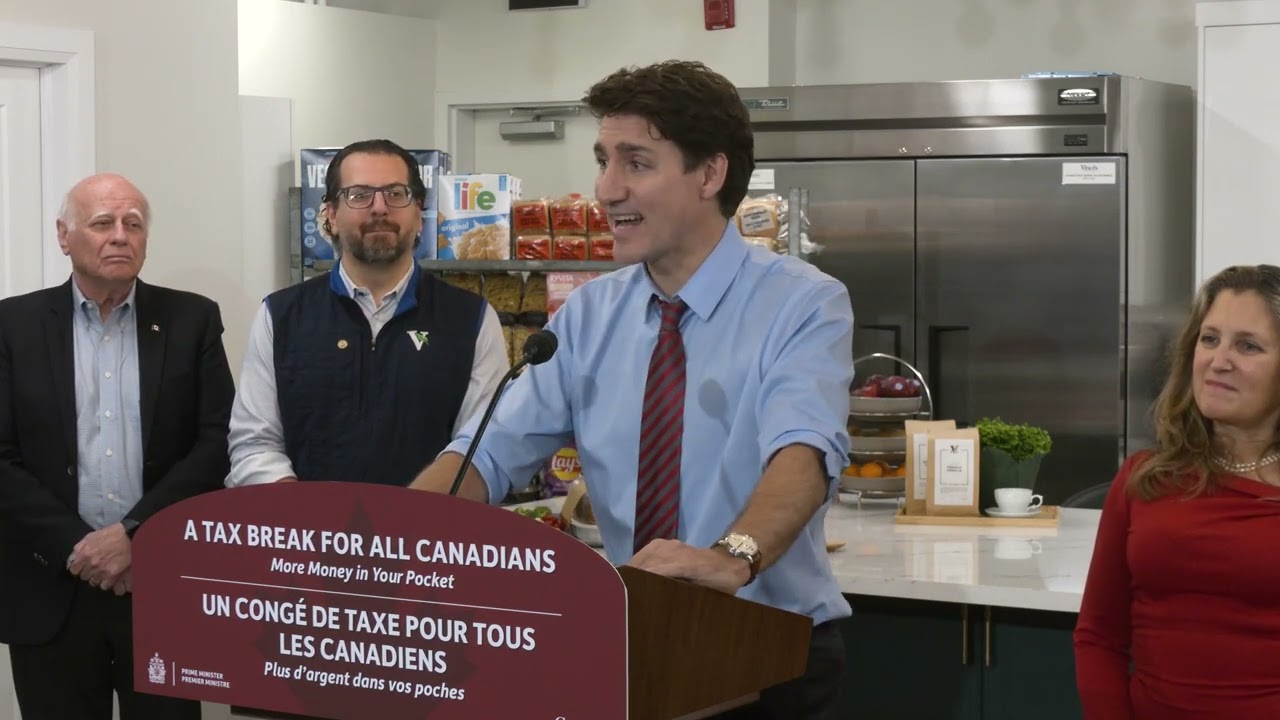

The holiday season is approaching, and the Canadian government is introducing a measure designed to make it a little easier for individuals and businesses. From December 14, 2024, to February 15, 2025, there will be a two-month Goods and Service Tax (GST) and Harmonized Sales Tax (HST) break on qualifying goods, including groceries, holiday essentials, children’s items, and more. This initiative aims to provide an estimated $1.6 billion in federal tax relief. Here’s how it could impact you:

For Individuals: More Savings at Checkout

The GST/HST break applies to a broad range of items you likely purchase during the holiday season, including:

- Groceries and restaurant meals: Whether you’re cooking a family feast or dining out, all food and beverages (including alcohol under 7% ABV) will be GST/HST-free.

- Children’s essentials: Save on clothing, footwear, diapers, car seats, and toys.

- Holiday decorations and gifts: Items like Christmas trees, books, and video game consoles are included.

- Miscellaneous items: Snacks, treats, and even prepared food platters are covered.

For families, this tax break could mean significant savings. For example, in Ontario, a $2,000 spend on qualifying goods results in $260 in HST savings. With the rising cost of living, this temporary relief could help stretch your holiday budget further.

For Business Owners: Adjustments at Checkout

If you run a business, particularly in retail or hospitality, you’ll need to be prepared for the temporary removal of GST/HST on qualifying items. Here’s what you need to know:

- Implementation: Starting December 14, 2024, you’ll need to ensure the GST/HST is not charged on qualifying goods at checkout. Updating your point-of-sale systems and staff training will be essential.

- Inventory Considerations: If you stock qualifying goods, such as children’s toys, books, or Christmas trees, this tax break could boost sales during the holiday season. Promote these items to attract cost-conscious customers.

- Documentation: Keep detailed records of GST/HST-exempt sales for reporting and compliance purposes. This will be critical if you’re audited or need to adjust your tax filings.

- Impact on Catering and Restaurants: If you operate in the food and beverage industry, this initiative applies to meals, snacks, and beverages. This could increase foot traffic, so ensure your team is ready for a potential surge in demand.

Additional Benefits for Families and Communities

Beyond the holiday cheer, this tax break may provide long-term benefits:

- Easing inflation pressures: By reducing the cost of essential goods and services, families can allocate more funds to savings or other needs.

- Boosting local businesses: With more disposable income, consumers may be more inclined to shop locally, benefiting small businesses.

How AMR Services Can Help

We can assist with:

- Tax Compliance: Ensuring your business is fully compliant with the temporary GST/HST changes.

- System Updates: Helping you implement changes to reflect the tax break.

- Financial Planning: Assessing how the savings can fit into your broader financial strategy, whether you’re a family planning your holiday budget, or a business forecasting year-end sales.

If you have questions about how this affects your specific situation, feel free to contact us for tailored advice.